Attracting a new customer is difficult and expensive. Anyone who’s tried to build a business knows that from experience. When you do attract a customer, you want to keep them!

Keeping customers isn’t free either, of course, but it’s still much cheaper than finding new ones. According to the Harvard Business Review, “acquiring a new customer is anywhere from five to 25 times more expensive than retaining an existing one”.

That means that a significant percentage of your analytics efforts should be focused on churn, more specifically, the customer churn analysis.

What Is Customer Churn Analysis?

Churn, or churn rate, is a metric that measures the percentage of customers who fail to make a repeat purchase (or who discontinue their subscription) during a given time period. Similarly, customer churn analysis is a method you can use to measure and better understand this rate, as well as what it means for your business.

The opposite of churn is customer retention. After a customer makes their first purchase, they will ultimately either buy again (they were retained) or not (they churned).

For example, if 90% of a streaming media company’s subscribers are retained (i.e., they renew their subscriptions each month), that means that the company has a monthly customer churn rate of 10% and a customer retention rate of 90%.

This is important because, as we mentioned earlier, keeping existing customers is significantly cheaper than attracting new ones.

Reducing churn means you’re keeping customers for longer, increasing their customer lifetime value (LTV), and getting more value from your marketing spend.

But the value of reducing churn goes beyond just that. Customer churn analysis will ultimately help you identify the weakest elements of your customers’ experiences and your product, enabling you to improve upon them.

That, in turn, will lead to happier customers. In addition to the financial benefits of keeping customers happy, there is a huge amount of marketing value in having customers who will rave about your product.

Another important reason to analyze churn is that if you don’t, you could be missing some large business problems.

For example, imagine a company that begins the year with 2,500 customers, and ends the year with 5,000. That sounds great, right? They doubled their customer base!

However, the churn could tell a different story. It’s possible that over the year they churned 3,500 customers.

That would mean the marketing and sales teams are doing well; they brought on 6,000 new customers. But it would also mean there’s a serious problem with customer retention.

And since signing up a new customer costs much more than retaining an existing customer, all of those new signups probably came at a significant cost.

If this business had been doing regular churn rate analysis, they could have caught and fixed the problem causing the churn earlier.

All of this makes churn rate one of the most important customer metrics.

What Is a Good Churn Rate?

Churn rates vary from company to company and industry to industry, and what’s considered quite good in one industry might be quite bad in another.

For example, the average churn rate for a subscription box company is roughly double the churn rate for a media/entertainment company. To figure out whether you have an acceptable churn rate, you’ll need to look at the specific numbers for your industry.

It’s also worth mentioning that churn rate can be complicated somewhat by a related factor: expansion. Expansion refers to customer accounts that are generating increased revenue, and it is often discussed in tandem with churn.

For example, imagine you run a financial services company with two subscription tiers, a $10 tier, and a $100 tier.

In a given month, if you can get two $10 customers to become $100 customers, that’s a $180 increase in revenue — more than enough to offset a few $10 customers churning.

The above scenario would be an example of a net negative churn rate, where the increased revenue from growing accounts is higher than the decreased revenue lost to accounts that churned.

Conversely, a company with a net positive churn rate is losing more revenue to churned accounts than it is gaining in account expansions.

Don’t worry if this all sounds a bit complicated. The bottom line is actually quite simple: regardless of whatever else is going on with your business, you want to reduce churn as much as possible.

How Is Churn Rate Calculated?

The basic equation for calculating the churn rate over a given time period is this:

(Number of Lost Customers / Starting Number of Total Customers) Multiplied by 100 = Churn Rate

For example, if a company starts a month with 5,000 customers and loses 50 over the course of the month, then their churn rate for the month was 1%.

In calculating churn rate, the challenge usually lies not in the mathematics, but in the actual gathering of data. Do you have accurate customer counts? Do you keep careful track of customers who cancel or customers who’ve stopped making purchases?

For subscription-based services, the lines are relatively clear — someone is either still a paying subscriber or they are not.

For retail and sales-based businesses, though, they will have to determine where to draw the line: At what point does an inactive former customer become “churned”?

Precisely where and how that line is drawn will vary by industry and company. Typically, a thorough analysis of your company’s customer retention metrics will help you figure out precisely how to define “churned” for your business.

Customer Churn Analysis Example

Imagine a SaaS startup with $10 and $100 subscription tiers that wants to understand their churn rate to improve customer experience, customer engagement, customer retention (and retention rate), and LTV.

First, they’ll need to set up tracking to ensure that they’re aware of when customers subscribe, unsubscribe, and change their subscriptions. Having accurate tracking and data storage for these events is critical.

Next, they’ll need to collate and analyze the data. Typically, this is done automatically using some sort of data analytics platform or a web analytics tool such as Woopra.

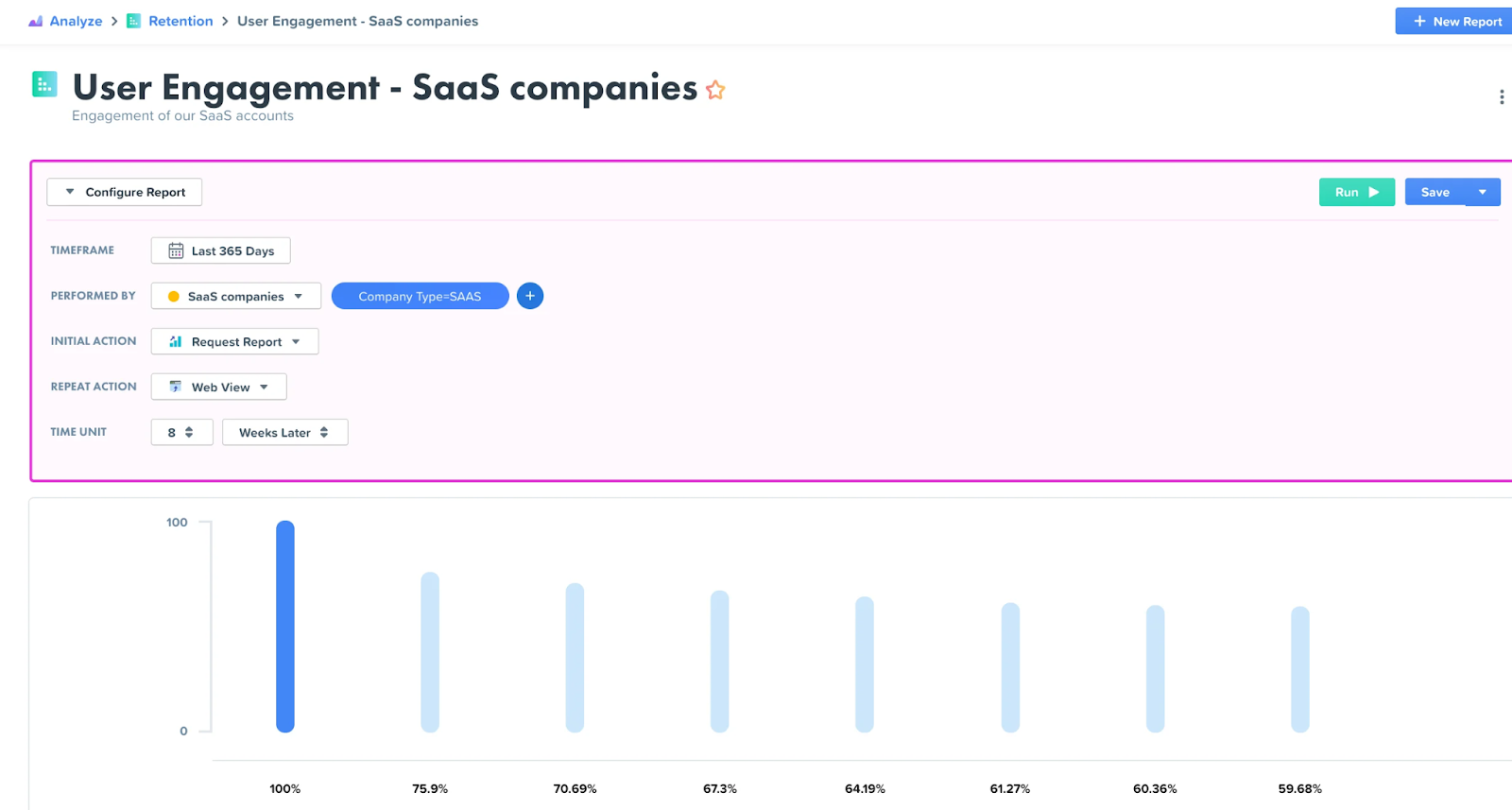

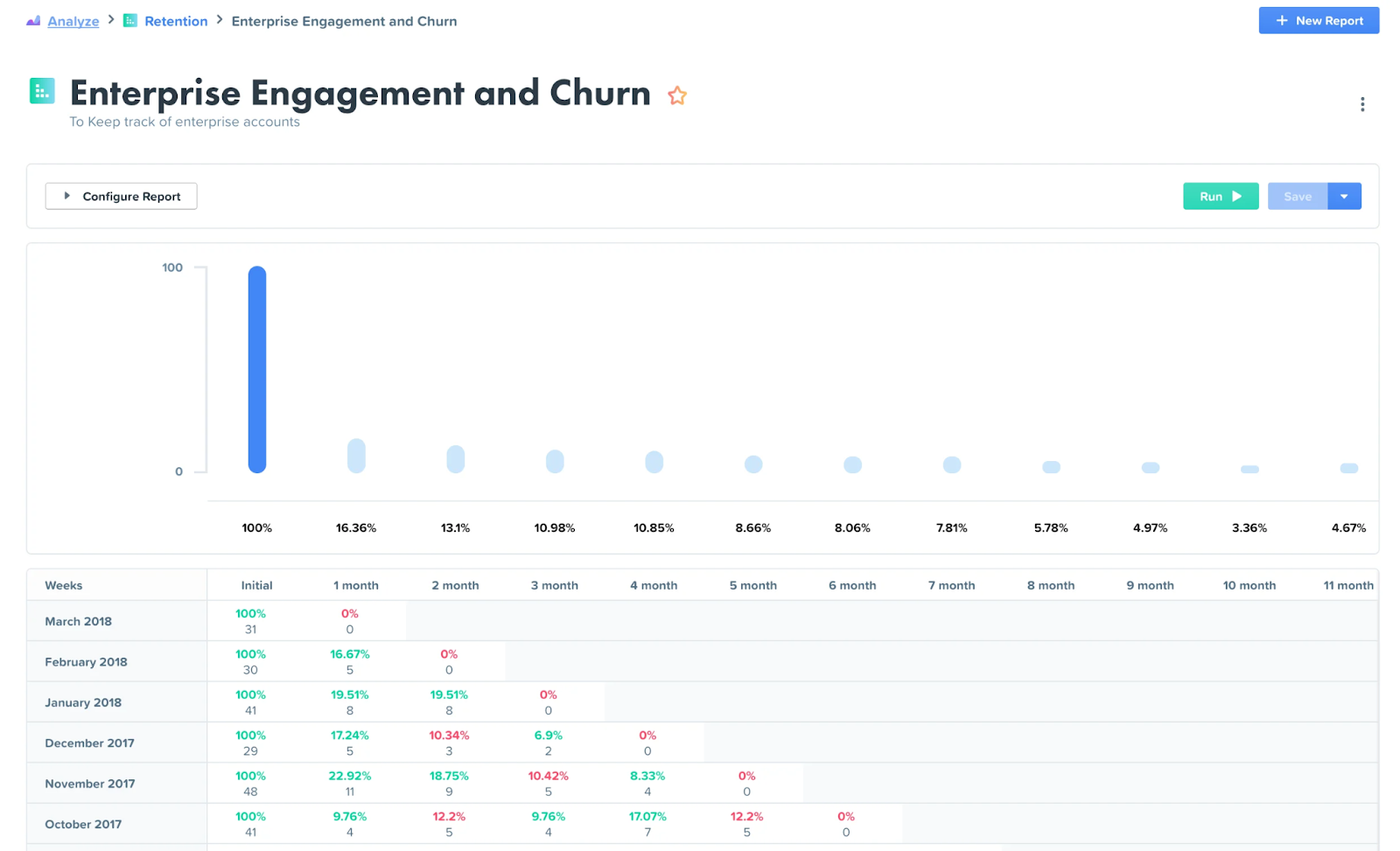

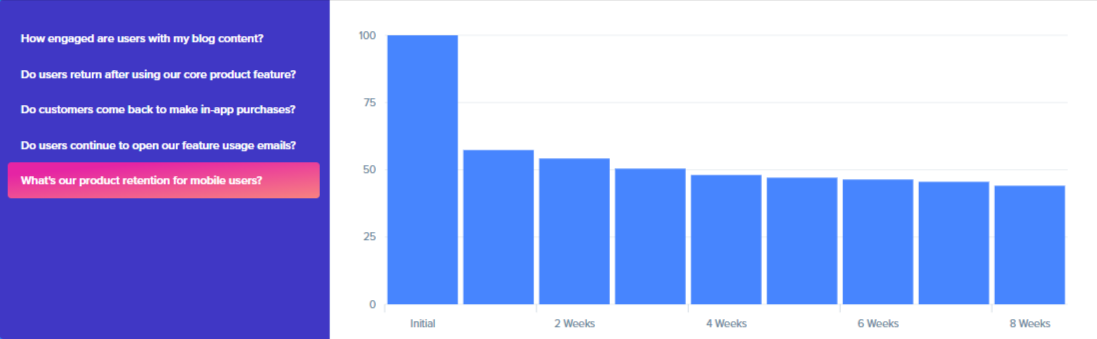

These tools will calculate churn rates using your data and present them in a variety of different visualization types.

Once the initial results have been calculated, the company will dig into them for insights. For example, they may look at a time series chart that shows their churn rate over time. Is it up or down month-over-month? Year-over-year?

If their analytics tool has the capability — and a good analytics tool should — they will also filter the results to look at specific user segments and other data. Is one type of user churning more frequently than another? Are users who touch a specific feature churning less?

The initial results of a customer churn analysis could indicate that things are great — you’ve got a lower-than-average churn rate for your industry and things are headed in the right direction.

But if the initial results aren’t perfect, filtering and using customer segmentation can help you pinpoint areas where you can improve.

How to Analyze Churn

Step 1: Set Up Tracking

Before you can analyze churn, you have to ensure that you’ve got all of the necessary tracking in place so that you can measure it correctly.

For example, let’s say you’ve got a subscription-based business and you’d like to conduct churn analysis using Woopra. You’ll need to make sure you set up an event to fire when any of the following three things occur:

- A customer creates a new subscription

- A customer modifies an existing subscription

- A customer cancels a subscription

In Woopra, you would create a “Subscription Update” event that fires when a user takes any of those actions and define your schema for the relevant data, such as:

- The customer’s beginning annual customer value (ACV)

- The customer’s ACV after their subscription change

- The difference between the two (final ACV - beginning ACV)

So, for example, a subscriber who switches from a $100/month plan to a $50/month plan would have a beginning ACV of $1200 and a final ACV of $600, for a difference of -$600.

Once you’ve set up the tracking in your product and defined the schema for your subscription update event, there’s nothing else you need to do. Woopra will automatically begin recording your data so that you can start tracking your churn.

If you’re not using Woopra, you may need to figure out how to do this using other tools or some custom coding, but the basic principles are the same: You need to track all subscription changes, including your “before” and “after” customer values.

Step 2: Calculate and Visualize

Once everything is set up, the next step is… to wait.

That’s not very exciting, but churn is a phenomenon that happens over time. Since you weren’t tracking subscription changes before completing step one, you won’t immediately see any data.

Over time, however, the results will start to come in. Woopra automates the calculations and presents them to you using automated reports with daily, monthly, yearly, and customized time period options.

In these reports, you’ll be able to see financial totals for churn (subscriptions downgraded or lost), new subscriptions and expansions, and the total number of users taking each of these actions.

You’ll also be able to break this big data down to look at monthly recurring revenue (MRR) and annual recurring revenue (ARR).

This information alone is enough to give you a pretty good overview of the revenue churn situation, particularly when visualized in the charts Woopra provides that make it easier to interpret at a glance.

But it’s important not to stop there because that’s just the tip of the iceberg.

Step 3: Analyze and Monitor

At this point, you’re collecting all of the subscription update data that’s needed to track churn, and you’ve got reports that are telling you about the overall revenue change and churn rate that your company is experiencing.

But you don’t just want to know what your churn rate is, you want to improve it! To do that, you need to understand who is churning, when they are churning, and why they are churning — their churn reason.

To understand those things, you’ll need to dig deeper into the customer data, filtering by specific user segments and cohorts to look for trends.

The specifics of what you need to look for will vary from company to company, but here are some questions to give you an idea of the type of things you could look into if, for example, you see an increase in the overall churn rate:

- Time-based user cohorts: Are users who signed up at a particular time more or less likely to churn?

- Feature-based user segments: Are users who tried a particular feature more or less likely to churn?

- Touchpoint-based user segments: Are users who read a particular email more or less likely to churn?

- Service-based user segments: Are users who give certain net promoter score (NPS) ratings churning more?

- *Customer behavior-based segments: *Are users that take certain actions more likely to churn?

Woopra makes this kind of filtering really easy to do because its event-based tracking follows individual users over the course of their entire customer journey. If you’re tracking a user action, you can use it in a filter to see how users that take that action are churning.

Whatever tool you’re using, you’ll want to be sure it can track a wide variety of user actions (ideally, the entire customer journey) and that you’re able to connect that customer churn data to individual users so that you can filter churn reports based on user segments, cohorts, etc.

You can also go deeper, using predictive analytics to help you make predictions about customer attrition before it happens.

Effective customer churn predictions through predictive analysis can greatly increase your retention rate, and if your prediction is accurate, it can often give you a good idea of how you might be able to improve.

Why You Need to Analyze Churn Rate Frequently and Accurately

Churn rate analysis isn’t a one-time thing. It should be a fundamental and regular part of your analytics work.

At a minimum, you’ll want to ensure you’re looking at churn once a month (once a week is better) and answering the following questions:

- Is the tracking working correctly (i.e., do the numbers make sense)?

- What has changed since the last time you looked?

- What is the overall trend and what are the trends for your most meaningful/important user segments?

Needless to say, if you find anything that raises questions or concerns, a more thorough dig into the data is warranted.

The reason you need to check and analyze this number frequently is that, as mentioned earlier in this post, big business metrics like “total ARR” or “total subscribers” can hide serious business problems that churn will reveal.

And even if there aren’t serious business problems under the hood, churn analysis often turns up opportunities to make your product, marketing, customer service, etc., even better.

When you understand what user actions and interactions lead to churn, you can make improvements that will ultimately reduce that churn.

Tips on Reducing Churn Rate

There’s no magic bullet for reducing churn and increasing retention, and the best methods may be specific to you and your business. But there are a few things you can do that almost always work to reduce churn.

First, ask for customer feedback early and often. While checking your churn rate regularly can help you catch problems fast, asking for user feedback can help you increase retention by catching problems before your users actually churn.

Second, educate your customers even after they’ve purchased or subscribed. Don’t assume that because they’ve made a purchase, they understand how to get the value they want from your product. Improve customer success through educational videos, good documentation, etc.

Third, stay engaged. Unengaged customers become churned customers. Building a meaningful customer relationship increases customer satisfaction and by extension, customer loyalty, which in turn increases your retention rate and lowers churn probability.

Fourth, build a user community. This is part marketing, part customer service, and — when it works — part magic, because your loyal customers become your marketers, customer service reps, and the source of some great ideas for new features and improvements.

Fifth, focus on the retention of your most profitable segments. While it’s important to understand both, at the end of the day, raw churn percentage isn’t as important as revenue churn rate. Giving your most important users a great customer experience is priority one.

Letting your low-value users churn in higher numbers can be the right call if it gives you room to focus on retaining your most valuable customers.

Sixth, consider offering incentives. You can often retain quite a few customers by offering a discount to users attempting to cancel. Test different discounts and offers to see which one is the most effective.

Seventh, keep your eyes on the competition. Remember that churn might not indicate a problem with your product — it could reflect that you have a competitor who’s now doing something better, or who now offers a valuable new feature.

Ultimately, the best defense against voluntary churn is having a great product that users love.

That’s easier said than done, of course! But with the help of regular, in-depth churn analysis, you can understand what users really want based on what’s making them leave. Your product and your profits will be better for it.